Guided Investing

- You handle your investments personally, with our online support

- Help when choosing an ABN AMRO ESG Profile Fund

- Experts manage the investment fund

- Get started in less than 5 minutes

- You can start with as little as €50

The ABN AMRO ESG Profile Fund explained

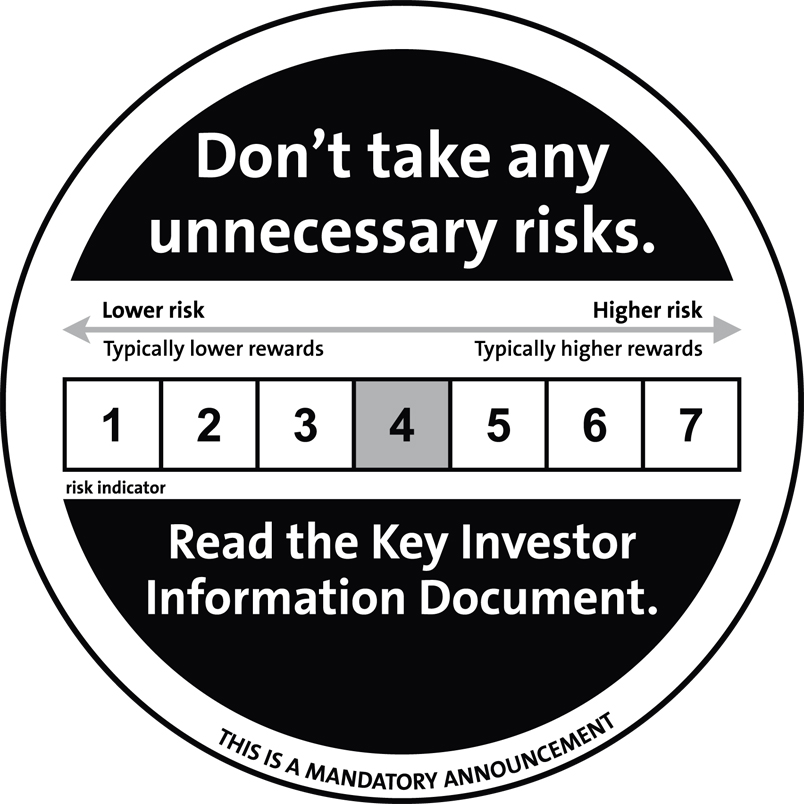

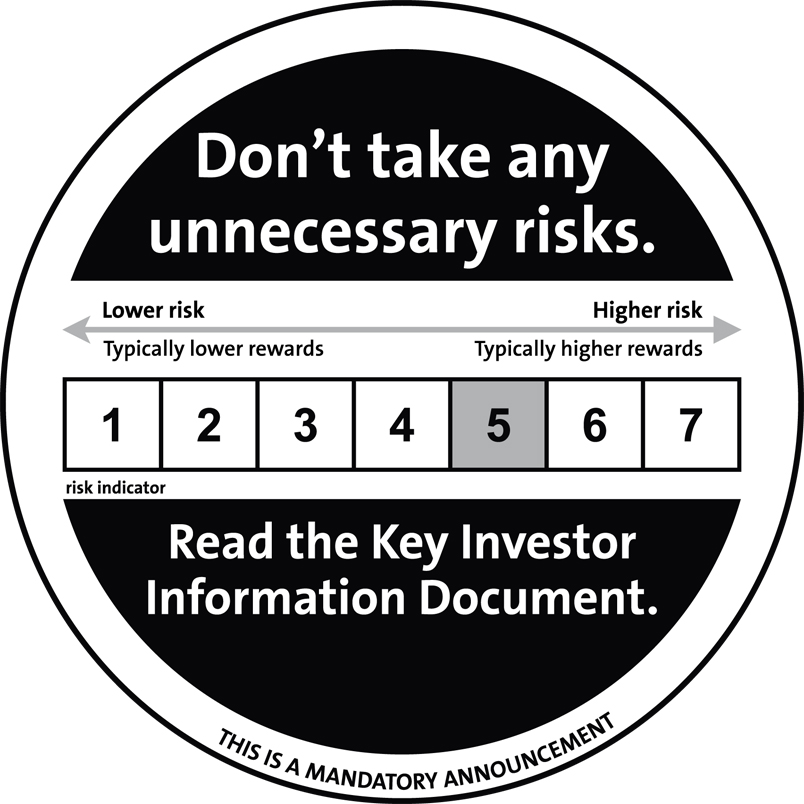

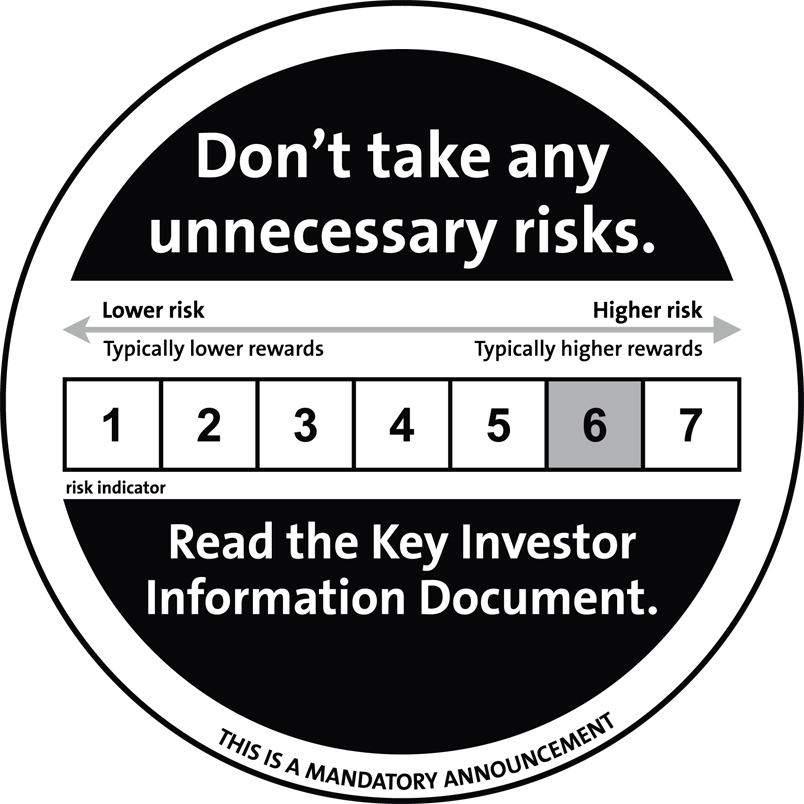

Guided enables you to invest independently in one of ABN AMRO’s ESG Profile Funds. There are five investment funds, which are all managed by expert fund managers. Every fund has its own characteristics and different risks. You receive online assistance when choosing your ABN AMRO ESG Profile Fund. Please, note this not an investment advice.